Last Update: 06/12/2025

Potential New Tax Breaks on RV and Truck Loans

Thinking about buying a new camper? A proposed tax bill might help you keep more money at tax time.

It’s nicknamed the One Big Beautiful Bill (yep, that’s really what they’re calling it), and it’s packed with proposals that could benefit RV buyers and owners.

If it passes and becomes law, you might be able to deduct up to $10,000 a year in loan interest on an RV or tow vehicle from your federal tax return. Seniors could qualify for even more.

Some behind-the-scenes tax perks for RV dealers might trickle down to buyers — potentially reducing costs or improving deals behind the scenes.

There’s real potential to keep more of your money — but only if you know how it works.

In this guide, I’ll break it all down. No tax jargon. No politics. Just clear info on what this bill could mean for you — and how to make the most of it if it passes.

I’ll keep this updated weekly as the bill moves forward.

Let’s dive in.

🏛️ Bill Status Update (as of June 12, 2025):

The One Big Beautiful Bill passed the U.S. House of Representatives in a narrow 215–214 vote. It’s now being debated in the Senate, where lawmakers hope to vote by July 4.

Several proposed amendments are on the table — including changes to income limits, loan qualifications, and the senior bonus deduction — so the final version could look different from what’s currently proposed.

We’ll keep this article updated as the bill moves forward.

Table of Contents

Potential New Tax Breaks on RV and Truck Loans

What Is the One Big Beautiful Bill?

How the One Big Beautiful Bill Could Help RV Buyers

What are the Requirements to Qualify for the One Big Beautiful Bill’s Tax Deduction?

Bonus Tax Deduction for Seniors Under the One Big Beautiful Bill (65+)

Tax Basics to Know Before We Dive In

How the Big Beautiful Bill Tax Deduction Could Work in Real Life

Should You Pay Cash or Finance Your Camper?

Which Is Better: A Lower Interest Rate or a Tax Deduction?

Why a Dealer Tax Break Might Actually Help You

Other Big Beautiful Bill Tax Changes You Should Know About

3 Ways to Use the Big Beautiful Bill to Spend Less on a Camper or Tow Vehicle

Moves You Can Make While Congress Decides

Big Beautiful Bill RV FAQ: Your Top Questions, Answered

What Is the One Big Beautiful Bill?

The One Big Beautiful Bill is a proposed federal law currently being debated in Congress. If it passes, it could bring major income tax breaks — especially for people buying an RV, a tow vehicle (like a truck or SUV), or for those age 65 and up.

The bill would let qualified buyers deduct up to $10,000 a year in interest paid on RV or tow vehicle loans from their federal income taxes. Seniors could qualify for even more.

That kind of deduction could reduce your taxable income by enough to lower your tax bill by hundreds — maybe even thousands — depending on what you paid in interest.

🧠 Did You Know…?

A bill is basically a proposal for a new law. It has to be approved by both the House and Senate, then signed by the President before it becomes official.

The One Big Beautiful Bill is still in the proposal stage — so it’s not law yet. But if it passes, these tax breaks could kick in as soon as next year.

📄 Read the Full Bill Text:

Big Beautiful Bill – PDF

H.R. 1 – One Big Beautiful Bill Act (Full Text)

Death and Taxes

There’s an old saying:

“The only two things you can count on in life are death and taxes.”

Well… we can’t help much with the first one.

But taxes? That’s where deductions come in. . .

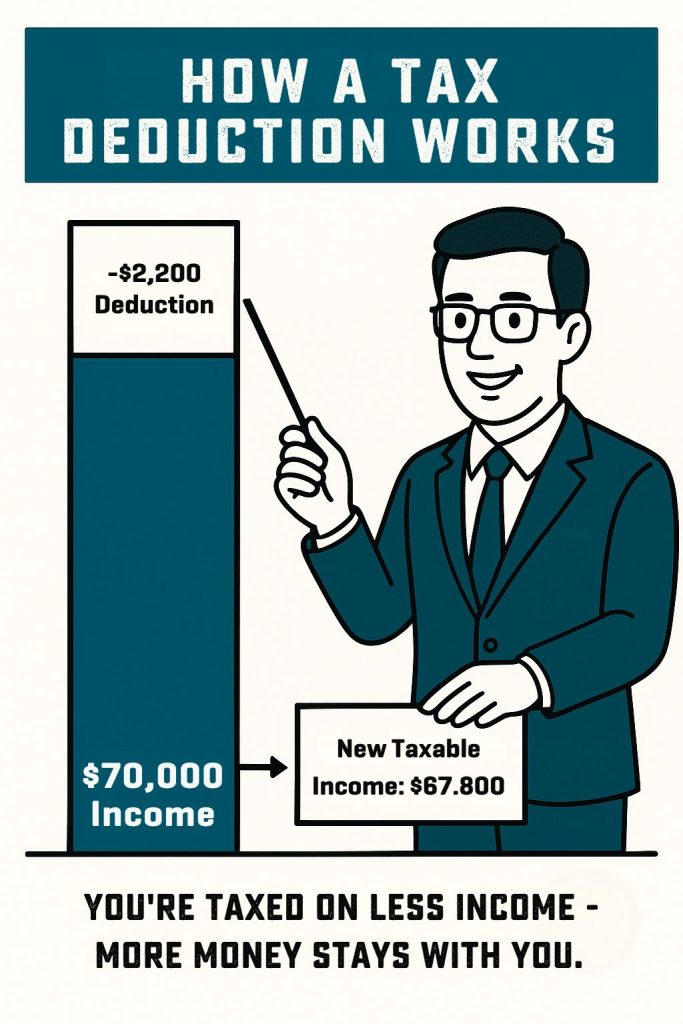

What’s a tax deduction?

A tax deduction lowers the amount of your income the government can tax — which means you pay less at tax time.

Think of a deduction like a coupon for your income. If you earn $70,000 and get a $2,200 deduction, the IRS acts like you only made $67,800. You don’t get that money handed back to you — but you do get taxed on less of your income, and that could mean hundreds of dollars in savings.

How the One Big Beautiful Bill Could Help RV Buyers

What tax deduction does the One Big Beautiful Bill offer for RV buyers?

The One Big Beautiful Bill proposes allowing buyers to deduct up to $10,000 per year in interest paid on loans used to purchase qualifying vehicles — including RVs and tow vehicles — from their federal income taxes.

📌 Important: It’s not a flat $10,000 deduction. You can only deduct the amount of interest you actually paid on your loan that year — up to the $10,000 limit.

This isn’t a refund or rebate. Instead, it lowers the amount of income the IRS can tax — which could reduce your total tax bill.

Calculate how much your Big Beautiful Bill Interest Deduction could save you at tax time.

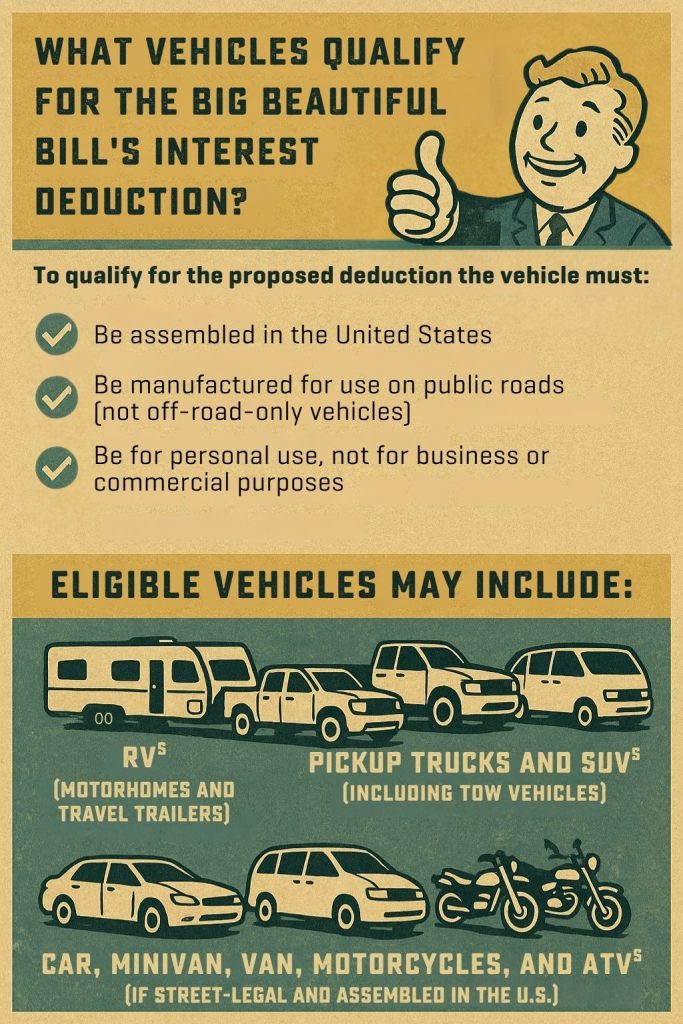

What vehicles qualify for the Big Beautiful Bill’s interest deduction?

To qualify for the proposed deduction, the vehicle must:

- Be assembled in the United States

- Be manufactured for use on public roads (not off-road-only vehicles)

- Be for personal use, not for business or commercial purposes

Eligible vehicles may include:

- RVs (motorhomes and towable campers)

- Pickup trucks and SUVs (including tow vehicles)

- Cars, minivans, vans

- Motorcycles and some ATVs (if street-legal and assembled in the U.S.)

What are the requirements to qualify for the One Big Beautiful Bill’s tax deduction?

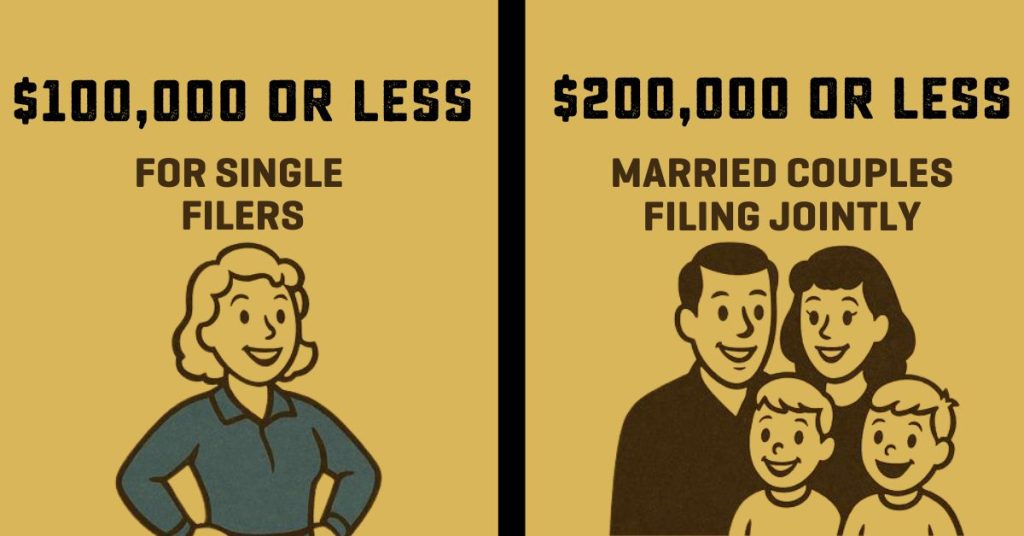

Income limits apply. To qualify, your adjusted gross income must fall below the following thresholds:

- $100,000 or less for single filers

- $200,000 or less for married couples filing jointly

If your income is above these limits, the deduction begins to phase out — and may not be available at all if your income is significantly over.

Can I claim the Big Beautiful Bill’s deduction if I use my RV for business?

No. The proposed deduction is specifically for personal-use vehicles only.

If you write off your RV or tow vehicle as a business asset, you likely won’t qualify for this specific tax break under the One Big Beautiful Bill.

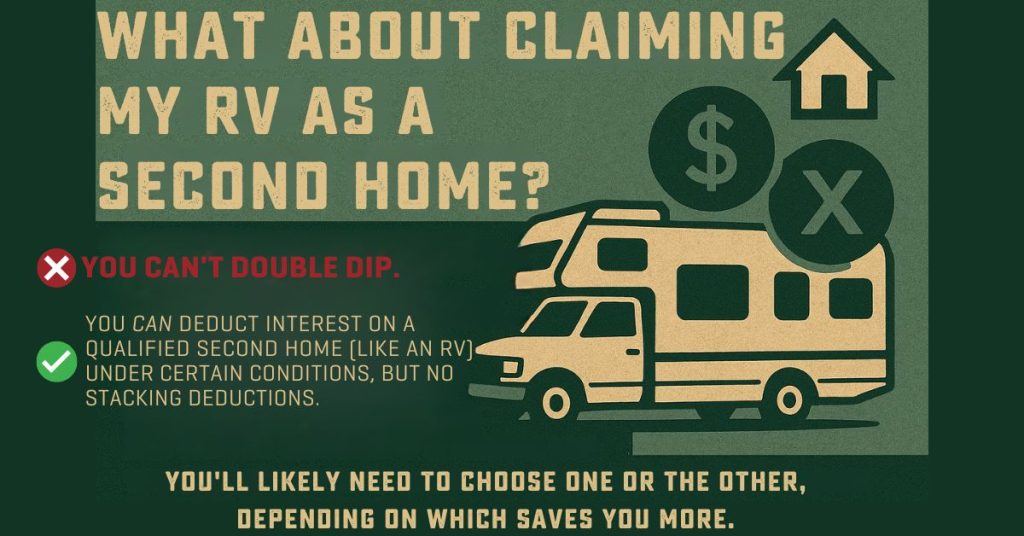

What about claiming my RV as a second home?

That’s a different deduction — and you can’t double dip. The current tax code allows you to deduct interest on a qualified second home (like an RV) under certain conditions, but you can’t stack that with this new interest deduction if it becomes law.

You’ll likely need to choose one or the other, depending on which saves you more.

Bonus Tax Deduction for Seniors Under the One Big Beautiful Bill (65+)

Is there an extra tax deduction if I’m 65 or older?

Yes. The One Big Beautiful Bill proposes an additional $4,000 deduction for individuals aged 65 and older. This bonus deduction is in addition to the standard deduction and is available to both itemizers and non-itemizers.

For married couples where both spouses are 65 or older, the combined bonus deduction would be $8,000.

What are the income limits for the senior deduction?

The proposed senior bonus deduction begins to phase out for taxpayers with modified adjusted gross incomes (MAGI) over $75,000 for single senior filers and $150,000 for married senior couples filing jointly.

Do I need to receive Social Security benefits to qualify?

No. Eligibility for the senior bonus deduction is based solely on age and income thresholds.

Receiving Social Security benefits is not a requirement.

For example, retired federal employees who do not receive Social Security benefits would still qualify for the deduction if they meet the age and income criteria.

(Source: Kiplinger.com)

Why does the bill include a senior bonus?

The additional deduction aims to provide tax relief to seniors, helping to offset the financial challenges faced during retirement. It is designed to assist older adults in managing living expenses, healthcare costs, and other financial obligations.

(Source: Fidelity.com)

🧠 Did You Know…?

If you’re 65 or older, you may already qualify for a higher standard deduction on your taxes. The One Big Beautiful Bill proposes an additional $4,000 deduction per filer, potentially increasing your total deductions and reducing your taxable income.

Tax Basics to Know Before We Dive In

“How does deducting the interest from my RV loan actually help me spend less on Taxes?”

Before we jump into the real-life examples, let’s go over a few tax basics — no jargon, just the need-to-know stuff.

What Does a Deduction Do?

A deduction reduces your taxable income — the amount the government uses to calculate what you owe.

Tax Deduction Example:

If you make $90,000 and you deduct $3,000 in RV loan interest…

You’re now taxed on $87,000 instead of $90,000.

If you’re in the 22% bracket, that could save you ~$660 at tax time.

($3,000 x 0.22 = $660)

📌 Note: You don’t get a check for $3,000. You save the tax on that $3,000 — which could be a few hundred dollars depending on your bracket.

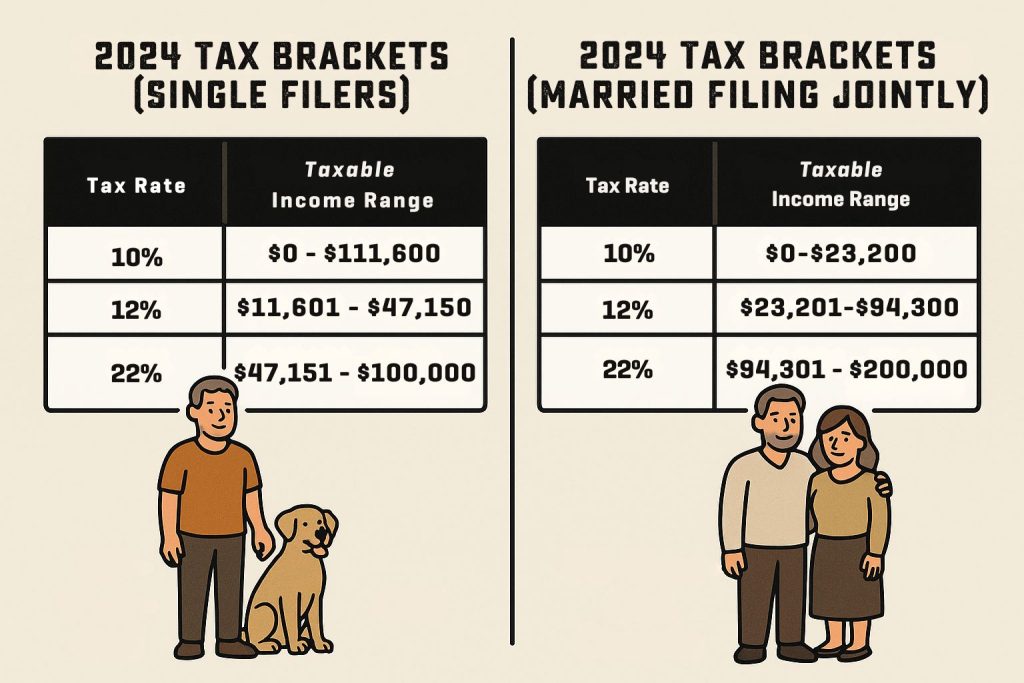

What Are Tax Brackets?

Your income isn’t taxed all at once — it’s taxed in layers.

Each “layer” has a different tax rate. These are called tax brackets.

Let’s say you make $80,000 and you’re filing as an individual

You don’t pay the same rate on all $80,000 — only the part that falls in each bracket.

So even if your top bracket is 22%, your average rate might be closer to 13–16%.

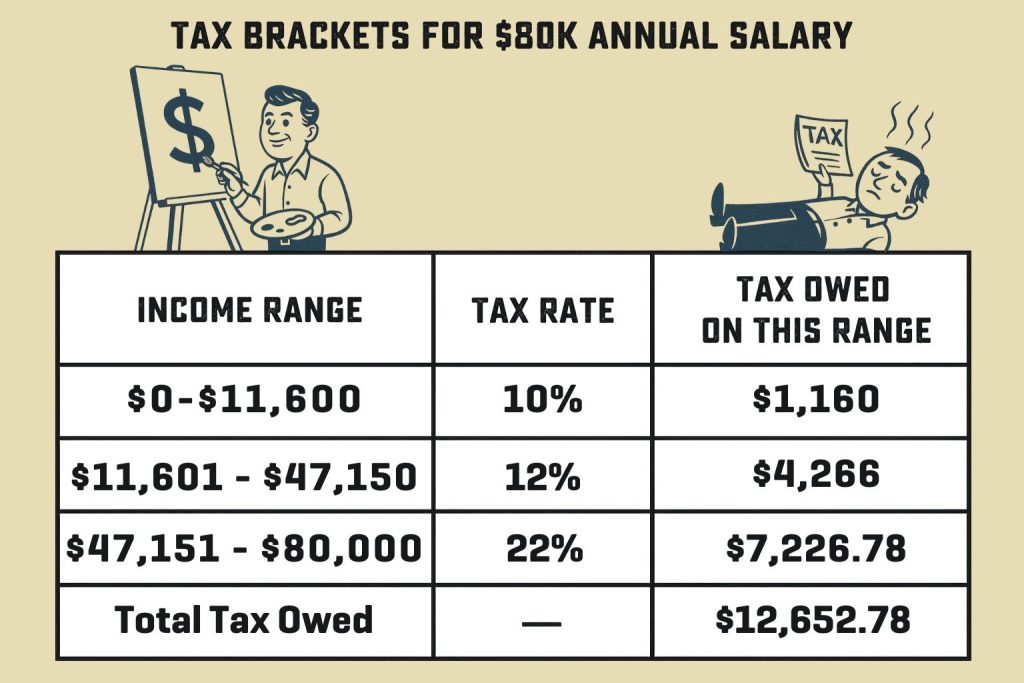

Tax Bracket Example: How Someone Earning $80,000 Is Taxed

(2024 Brackets – Single Filer)

Federal income tax in the U.S. is progressive — meaning you’re taxed in chunks at different rates, not one flat rate on your entire income.

Here’s how it works for someone making $80,000:

So, in the $80,000 example, even though they are in the 22% tax bracket, they don’t pay 22% on all $80K of their income — just on the portion above $47,150.

The total taxes they end up owing is $12,652.78 – about 15.8%.

How a Deduction Helps Reduce Taxes

Let’s say this same person deducts $5,000 in RV loan interest using the One Big Beautiful Bill:

- That drops their taxable income from $80,000 → $75,000

- That $5,000 would be deducted from the top (in the 22% bracket)

- So they save $1,100 in taxes (22% of $5,000)

How the Big Beautiful Bill Tax Deduction Could Work in Real Life

Three RV buyers. Three different situations. One potential tax break.

These examples show how the proposed Big Beautiful Bill could reduce your tax burden if it passes.

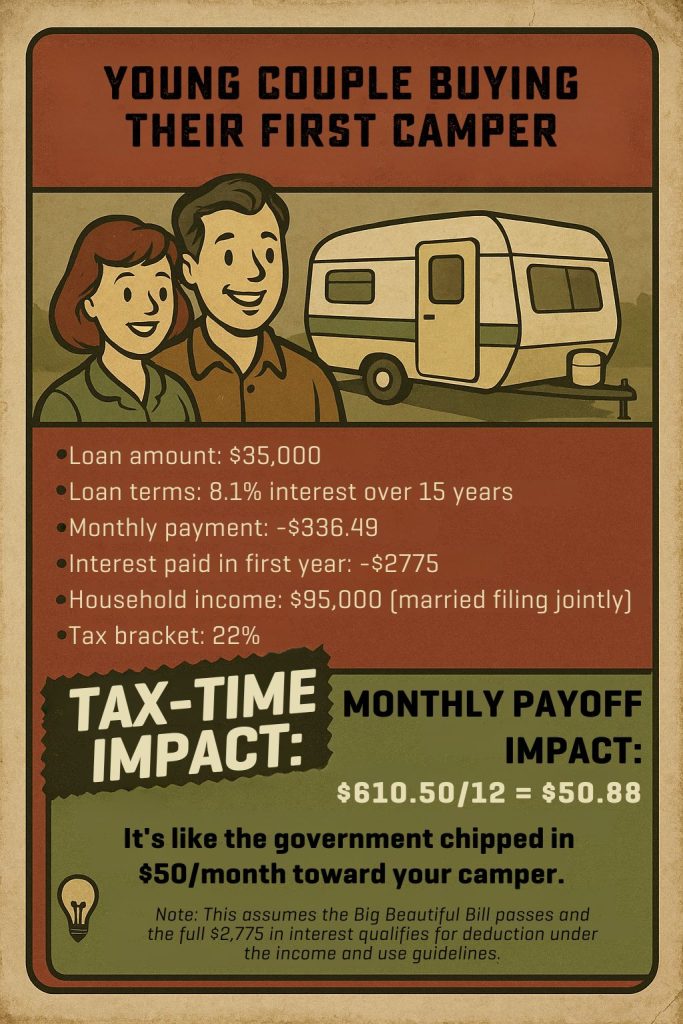

Example 1: Young Couple Buys Their First Camper

- Loan amount: $35,000

- Loan terms: 8.1% interest over 15 years

- Monthly payment: ~$336.49

- Interest paid in first year: ~$2,775

- Household income: $95,000 (married filing jointly)

- Tax bracket: 22%

Tax-Time Impact

They qualify for a tax deduction on the $2,775 in interest paid.

With a 22% federal tax rate, that deduction lowers their tax bill by:

$2,775 × 22% = $610.50 saved on taxes!

Monthly Payoff impact

$610.50 ÷ 12 = $50.88/month

It’s like the government helped cover nearly $51/month of their camper loan for the year.

📌Note: This assumes the Big Beautiful Bill passes and their income, use, and loan all meet the deduction guidelines.

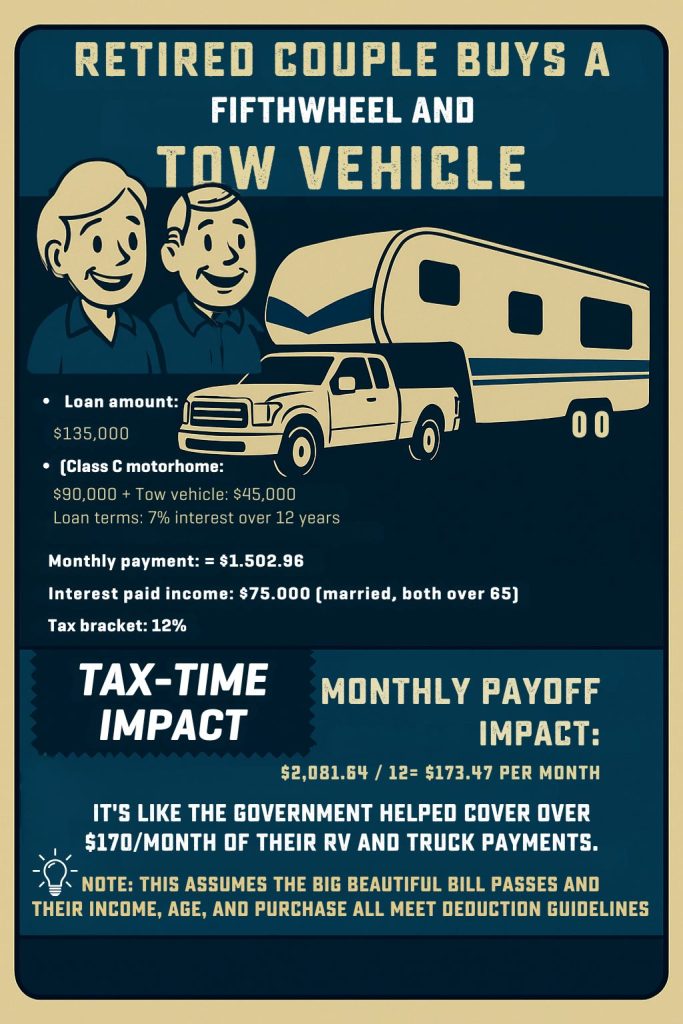

Example 2: Retired Couple Buys a Fifth Wheel and Tow Vehicle

- Loan amount: $135,000

(Fifth Wheel: $90,000 + Tow vehicle: $45,000) - Loan terms: 7% interest over 12 years

- Monthly payment: ~$1,502.96

- Interest paid in first year: ~$9,347

- Household income: $75,000 (married, both over 65)

- Tax bracket: 12%

Tax-Time Impact

They qualify for two deductions under the Big Beautiful Bill:

- Loan interest deduction: $9,347

- Senior bonus deduction: $4,000 per person = $8,000

- Total deductions claimed: $17,347

With a 12% federal tax rate, their tax bill drops by:

$17,347 × 12% = $2,081.64 saved on taxes!

Monthly Payoff Impact

$2,081.64 ÷ 12 = $173.47/month

It’s like the government helped cover over $170/month of their RV and truck payments for the year.

📌Note: This assumes the Big Beautiful Bill passes and their income, age, and purchase all meet the deduction guidelines.

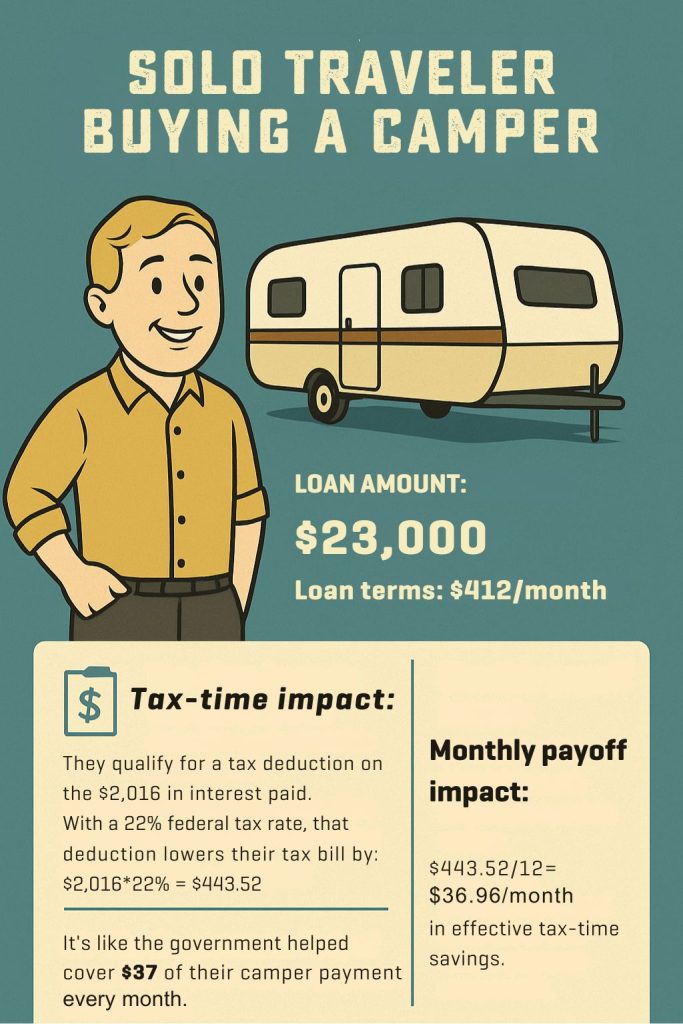

Example 3: Solo Traveler Buying a Go Play Camper

- Loan amount: $23,000

- Loan terms: 8.9% interest over 6 years

- Monthly payment: ~$412/month

- Interest paid in first year: ~$2,016

- Household income: $60,000 (single filer)

Tax bracket: 22%

Tax-Time Impact:

They qualify for a tax deduction on the $2,016 in interest paid.

With a 22% federal tax rate, that deduction lowers their tax bill by:

$2,016 × 22% = $443.52 saved in taxes!

Monthly Payoff Impact:

$443.52 ÷ 12 = $36.96/month

It’s like the government helped cover $37/month of their camper payments for the year.

📌Note: This assumes the Big Beautiful Bill passes and their income, age, and purchase all meet the deduction guidelines.

What These Real-World Examples Show

Whether you’re buying your first travel trailer, upgrading to a 5th wheel, or perfecting your solo setup — the Big Beautiful Bill could help you pay less at tax time. The key is understanding how your loan, income, and the new deduction rules fit together.

Even if you don’t max out the full deduction, every dollar of interest you deduct reduces your tax bill. And that adds up.

Check out our Free Big Beautiful Bill Savings Calculator.

Discover how much your Interest Deductions could save you.

Should You Pay Cash or Finance Your Camper?

Does the Big Beautiful Bill help if I pay cash?

No. The proposed Big Beautiful Bill helps only if you finance your RV or tow vehicle.

It lets you deduct loan interest from your taxes — but if you pay cash, there’s no loan and no interest, so no tax break.

Why would someone get a loan instead of paying cash?

Getting a loan spreads out the cost over time — so you can keep more cash in your pocket for other things like travel, upgrades, or repairs.

Example:

Let’s say you have $40,000 saved. You could pay all cash for a camper — but then your savings are gone.

If you finance instead, you make monthly payments and keep your savings as a safety net.

Is it bad to finance something that loses value?

It depends on your situation.

Yes, campers go down in value over time. But if financing helps you:

- Keep cash for emergencies

- Avoid draining your savings

- Get a newer or better model for less upfront

…then it might be worth it — especially if you get tax breaks on the interest through the Big Beautiful Bill.

How can I make financing work in my favor?

- Shop for the lowest interest rate you can find

- Put more money down to lower your loan amount

- Use the Big Beautiful Bill deduction (if it passes) to help offset some of the interest costs

📣 Quick Recap:

- The Big Beautiful Bill helps only if you finance — not if you pay cash

- Financing keeps cash available for other life expenses

- The interest deduction could make financing less expensive in the long run

Which Is Better: A Lower Interest Rate or a Tax Deduction?

Short answer: a lower interest rate usually saves you more money overall.

But — the new tax deduction could still put real cash back in your pocket — and getting both is even better.

Let’s break it down with simple examples…

What a Lower Interest Rate Does

Lower rates mean smaller payments and less total interest over time.

Interest Rate Example:

Loan amount: $45,000 over 10 years

- At 7.5% interest, you’ll pay about $18,970 in total interest

- At 8.8% interest, you’ll pay around $22,445

That’s a difference of $3,475 — just from a lower rate.

What a Tax Deduction Does

The Big Beautiful Bill would let you deduct up to $10,000 in interest you pay each year on your camper and/or tow vehicle loan.

You still pay the interest — but when tax time comes, you can subtract it from your taxable income. That could lower how much you owe (or increase your refund).

Tax Deduction Example:

You pay $7,500 in loan interest this year.

You’re in the 22% tax bracket.

$7,500 × 22% = $1,650 saved at tax time.

That’s money you keep — just for financing the right way.

What’s the Smartest Move?

If you can get both, that’s the best of both worlds:

- A lower rate means you pay less to the bank

- A tax deduction means you get more back from the government

Even if rates are higher right now, the tax deduction could soften the blow and make a financed RV or truck more affordable in the long run — especially if you’re on the edge about whether it fits your budget.

Why a Dealer Tax Break Might Actually Help You

You probably don’t care much about tax perks for RV dealers. But here’s the thing: this one could help you get a better deal when you buy your camper.

What’s the Dealer Floor Plan Deduction in the Big Beautiful Bill?

RV dealers usually borrow money to keep lots full of campers and trailers. It’s called a floor plan loan — kind of like a business credit card they use to stock inventory.

Right now, dealers can’t deduct all the interest they pay on those loans.

But the Big Beautiful Bill would bring that deduction back.

Why Should You Care?

If this passes, dealers could save thousands of dollars a year in interest costs.

That’s a big deal — because when dealers pay less to keep inventory, they’re often more flexible with pricing, especially if they’re sitting on RVs that haven’t sold quickly.

🚐 Bottom Line about the Dealer Floor Plan Deductions

You might never see this perk on paper — but if the bill passes, you could feel it in the final price of your RV.

Less financial stress for dealers = more room to make a deal.

Other Big Beautiful Bill Tax Changes You Should Know About

While most of the Big Beatiful Bill’s direct perks focus on income taxes and vehicle-related deductions, there are a few other changes that might affect your wallet — for better or worse.

- Business owners: The bill expands some business deductions, like bonus depreciation and Section 179 expensing. If you run a small business, this could free up cash — even if the RV doesn’t qualify as a business vehicle.

- Energy tax credits: Some popular tax credits for solar panels, insulation, and other home energy upgrades may be reduced or phased out. If you were planning those upgrades, it might be smart to act sooner rather than later.

3 Ways to Use the Big Beautiful Bill to Spend Less on a Camper or Tow Vehicle

If the proposed Big Beautiful Bill passes, you could save at tax time—but only if you use it right. Here’s how to make the most of it:

1. Finance (Don’t Pay Full Cash)

The Big Beautiful Bill only lets you deduct loan interest, not the price of the camper itself.

Paying all cash = no deduction.

Even a partial loan could help you claim hundreds in tax savings over time.

2. Put Around 10% Down (If You Can)

A down payment typically helps you qualify for a lower interest rate, which keeps your monthly payments manageable.

You’ll still have enough loan interest to deduct—without borrowing more than you need.

It’s about balance: just enough debt to unlock the tax perks, without overpaying in interest.

3. Compare Lenders and Loan Terms

Not all RV loans are created equal.

A slightly higher interest rate might give you a bigger deduction—but a lower rate could cost you less overall.

📌Tip: Use a loan calculator to see what gets you the best blend of monthly savings and tax-time payoff.

Moves You Can Make While Congress Decides

The One Big Beautiful Bill could be a game-changer for RV buyers — but it’s still just a proposed law, not official yet.

Congress is still debating the details, and there’s a chance things could change before it passes. Lawmakers are hoping to vote on it before July 4th, but nothing’s guaranteed.

That’s why our team at Bish’s RV is keeping a close eye on the updates — and we’ll share everything we learn as soon as we know it. If the bill passes, we’ll break down what it means for buyers and which RVs may qualify for the new tax deductions.

In the meantime, here’s what you can do now:

Next Steps You Can Take Today

See RVs that may qualify for Big Beautiful Bill Deductions

Talk to a finance expert about low-interest loans or budgeting options

Big Beautiful Bill RV FAQ: Your Top Questions, Answered

What is the “One Big Beautiful Bill” for RV buyers?

The “Big Beautiful Bill” is a proposed tax bill in Congress that could let RV buyers deduct the interest they pay on certain RV loans.

Think of it like the home mortgage interest deduction — but for your camper. It’s designed to make RV ownership more affordable, especially for middle-income earners and seniors.

Has the Big Beautiful Bill passed yet?

Not yet — but it’s getting closer.

As of June 12, 2025, the One Big Beautiful Bill has passed the U.S. House of Representatives by a narrow 215–214 vote.

It’s now in the hands of the Senate, where lawmakers hope to vote by July 4.

Several amendments are still being debated — including changes that could affect income limits, eligible vehicles, and the senior deduction — so the final version of the bill may look a little different.

We’re tracking it closely and will keep this article updated with the latest info.

How does the RV interest deduction work?

If you finance your RV with a qualifying loan, you can deduct the interest you pay each year from your taxable income. (up to $10,000)

That deduction can reduce how much you owe in federal income taxes — putting real money back in your pocket at tax time.

Who qualifies for the new RV deduction?

You might qualify if:

- You finance a new RV (some used models may qualify too — we’re waiting for final clarification).

- You meet the income limits (less than $100,000 individuals/less than $200,000 couples filing jointly)

- The RV is used for personal travel or living, not just as a rental or business vehicle.

We explain all the details earlier in this article, or you can talk to a Bish’s finance expert to see where you stand.

Can I deduct the full cost of my RV?

Nope — the deduction is for interest paid on your loan, not the full purchase price.

But if you take out a loan and pay, say, $7,000 in interest your first year? That’s the number you can deduct (if you qualify).

Does the Big Beautiful Bill apply to used campers too?

Possibly. The current language of the bill focuses on new RV purchases, but there’s room for interpretation — and amendments could expand eligibility to certain used models.

We’ll update this article as the bill evolves.

Can I still qualify if I pay cash for my RV?

Unfortunately, no. Since the benefit is based on loan interest, paying cash doesn’t generate a deduction. But if you finance even part of your camper, the interest on that amount could still count.

What kind of RV loans qualify?

Generally:

- The loan must be used to purchase a new or qualifying RV

- It must be through a recognized lender

- It needs to be paid over time (no same-year payoff)

Want to make sure your loan qualifies? Our finance team can walk you through your options.

Is there an income limit to get the deduction?

Yes — but it’s pretty generous. Most RV buyers will qualify. The deduction phases out above certain income thresholds, which we break down earlier in this article.

For most families earning under $200,000, there’s a good chance you’ll benefit.

How much could I save on my taxes with this new bill?

That depends on your income, tax bracket, and how much interest you pay.

In our real-world examples, buyers saved $300–$1,500 at tax time, depending on their situation. You can also break that down into monthly savings — kind of like Uncle Sam helping you make your camper payment.

Greg Long

Bish’s RV Content Manager

With over 10 years in the RV industry, Greg combines firsthand dealership experience with a passion for helping people find the right RV for their adventures. He’s walked thousands of campers, talked with real buyers, and believes the best RV advice should be clear, honest, and fun.

Amateur adventurer; professional dreamer.

aka: The Bish-Blog-Guy