Last Update: 06/13/2025

Would you like to save money on your taxes?

A new proposed law might help — especially if you’re planning to buy a camper or tow vehicle this year. It’s called the One Big Beautiful Bill (yes, really), and it’s already been approved by the House of Representatives.

The full proposal is loaded with fine print, but here are 3 key things every RVer should know — no tax jargon, just the useful information that could actually save you money.

Do you have to get a loan to qualify for the Big Beautiful Bill tax break?

Yes — the proposed law only helps if you get a loan. If you pay cash, you won’t qualify for the interest deduction.

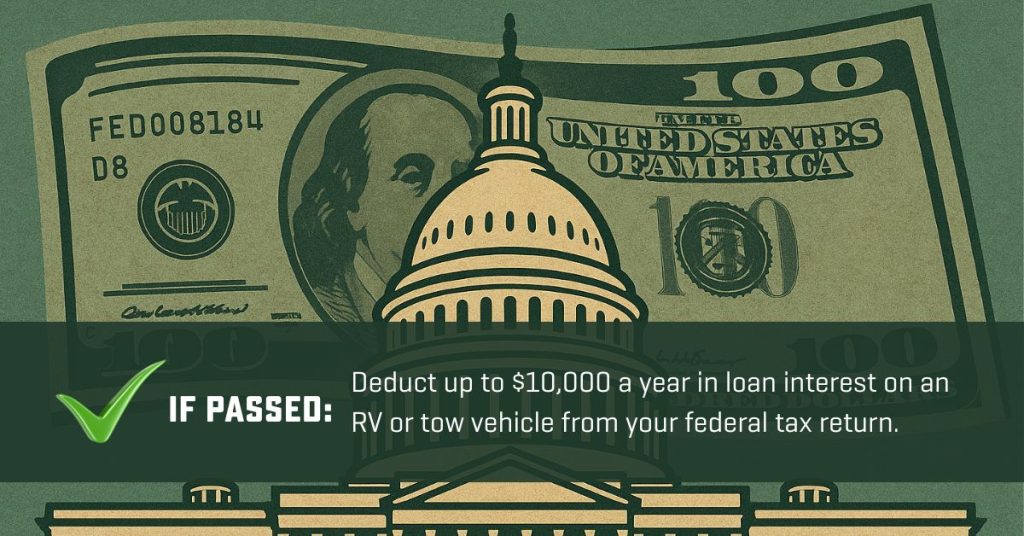

The One Big Beautiful Bill is a proposed law that would let RV buyers and tow vehicle owners deduct up to $10,000 a year in interest paid on a qualifying loan. But here’s the catch: the deduction only applies to interest on a loan — not the vehicle’s full price.

If you pay cash, there’s no loan… and no interest to deduct.

So if you were planning to pay all cash for your RV, you might want to rethink that — or consider getting a loan for part of the cost. Even a smaller loan could qualify you for hundreds in tax savings.

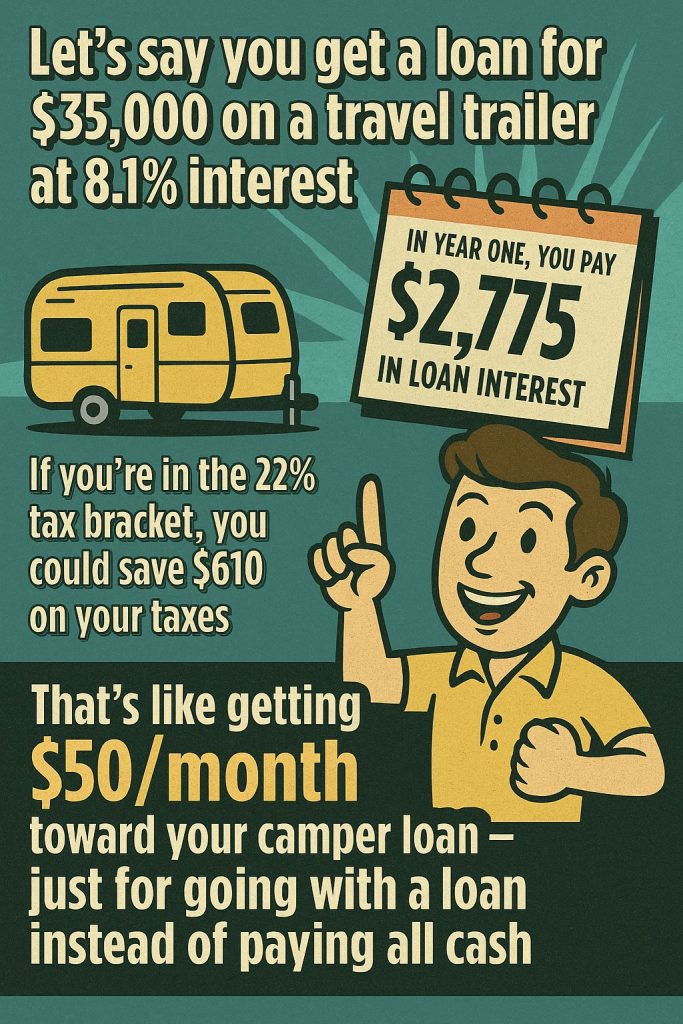

How the Big Beautiful Bill Tax Deduction Could Work For You:

(Real-World Example)

Learn all the details on How the Big Beautiful Bill Tax Deductions Work, so you can possibly save BIG at Tax Time.

📌 Quick tip:

You don’t have to borrow the full amount. Even getting a loan for part of your RV could give you a decent deduction.

See 7 Tips on getting the Best RV Loan for secrets on finding the best RV Financing.

Use our Dedcution Calculator to see how much you could save under the Big Beautiful Bill.

Is the Big Beautiful Bill tax break only for RV loans?

No — the proposed deduction isn’t just for RVs. It may also apply to loans on tow vehicles like trucks, SUVs, and vans — as long as they meet the right criteria.

The Big Beautiful Bill would let buyers deduct up to $10,000 a year in loan interest on qualifying personal-use vehicles, including both campers and the trucks that tow them.

So if you’re planning to buy a travel trailer and a new tow vehicle, there’s a good chance both loans could help lower your taxes — depending on how much interest you pay.

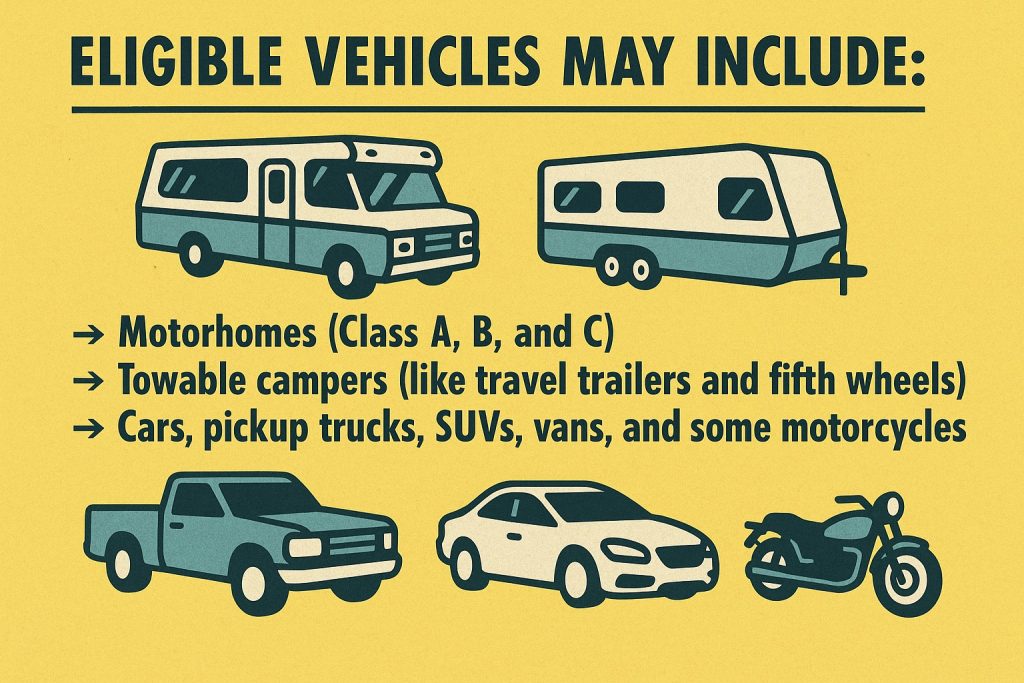

What vehicles qualify for the Big Big Beautiful Bill Tax Deductions?

To be eligible for the Big Beautiful Bill Tax Deduction, the vehicle must:

- Be used for personal travel (not business-only)

- Be assembled in the U.S.

- Be street legal (not off-road-only)

- Be purchased with a loan — not paid in full with cash

This includes:

- Motorhomes (Class A, B, and C)

- Towable campers (like travel trailers and fifth wheels)

- Cars, pickup trucks, SUVs, vans, and some motorcycles

What vehicles don’t qualify?

❌ Off-road-only vehicles

❌Business-only purchases

❌ Cash purchases (no loan = no interest = no deduction)

❌ Vehicles made outside the U.S.

📌 Quick tip:

The $10,000 deduction applies to all qualifying loans combined. So if you get a loan for both a camper and a truck, you could deduct interest from both — up to the limit.

Curious how much you could save?

Try our RV Loan Deduction Calculator »

Are there any other RV tax breaks in the One Big Beautiful Bill?

Yes — especially for buyers age 65 and up.

In addition to letting you deduct interest on your RV or tow vehicle loan, the Big Beautiful Bill includes a bonus deduction just for seniors. If you qualify, it could lower your taxable income by up to $4,000 per person — or $8,000 for qualifying couples.

That’s on top of any interest deduction you might already receive.

Who qualifies for the senior bonus?

- Anyone age 65 or older

- Couples can claim $8,000 if both spouses are 65+

- You don’t need to itemize — it applies to standard deductions too

- Social Security isn’t required — just age and income eligibility

- Income phase-out begins at $75,000 (single) and $150,000 (joint)

This bonus is meant to help seniors manage retirement expenses — especially when upgrading to a new RV or tow vehicle.

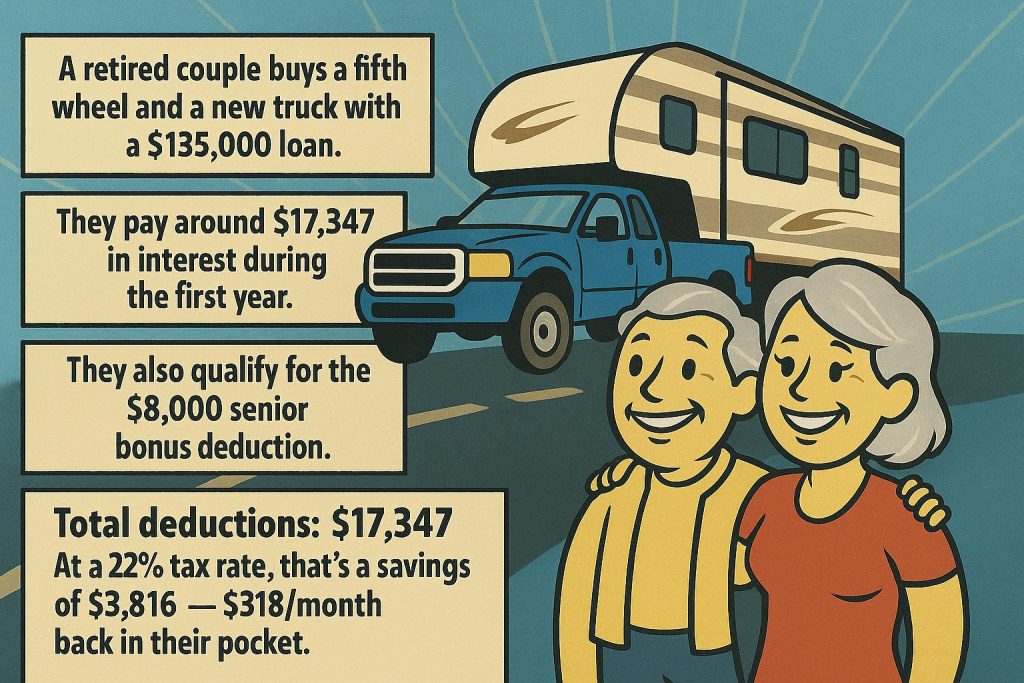

How the Big Beautiful Bill Tax Deduction Could Work For You if You’re 65+:

(Real-World Example)

A retired couple buys a fifth wheel and a new truck with a $135,000 loan.

They pay around $17,347 in interest during the first year.

They qualify for the $10,000 deduction plus the $8,000 senior bonus deduction.

Total deductions: $17,347

At a 22% tax rate, that’s a savings of $3,816 — $318/month back in their pocket.

📌 Quick tip:

Even if you don’t itemize your taxes, the senior deduction still counts — making it one of the easiest benefits to claim if the bill becomes law.

Want to know all the details every RVers should know about the Big Beautiful Bill?

Read the full Big Beautiful Bill guide »

How to Make the Most of the Big Beautiful Bill

If the Big Beautiful Bill becomes law, it could change how RVs and tow vehicles are taxed — and possibly save you some serious cash. Whether you’re thinking about a new camper, a truck to pull it, or both, it’s smart to know how this could work in your favor.

At Bish’s RV, we’ve been helping families find the right RV for the right price for almost 40 years. We keep up with the latest RV news and trends, and when something big like this comes along, we’ll make sure you hear about it — in plain English, not tax code.

No pressure. No jargon. Just the facts from someone who loves camping as much as you do.

Here’s how to get started:

See how much you could save on your existing RV Loan!

Try our Deduction Calculator.

Get all the details every RVers should know about the Big Beautiful Bill

Read the full Big Beautiful Bill RV Tax Guide »

See What Campers May Qualify–Floor Plans and Pricing

Frequently Asked Questions

Can I get the RV tax deduction if I pay cash?

No. The Big Beautiful Bill only allows a deduction on interest paid through a qualifying loan. If you pay cash, there’s no loan and no interest — so you won’t qualify for the tax break.

Does the Big Beautiful Bill apply to used campers?

No, not officially — at least not yet.

Right now, the bill focuses on new RV and vehicle purchases. Some used models might qualify depending on how the final law is written. We’ll update the guide as soon as those details are confirmed.

How much could I actually save on my taxes?

That depends on how much loan interest you pay and your federal tax bracket. Some buyers might save a few hundred dollars, while others — especially seniors or those financing both an RV and a tow vehicle — could save $2,000 or more.

Related Articles

7 Tips to get the Best RV Loan

How Much Does an RV Cost in 2025?

Greg Long

Bish’s RV Content Manager

With over 10 years in the RV industry, Greg combines firsthand dealership experience with a passion for helping people find the right RV for their adventures. He’s walked thousands of campers, talked with real buyers, and believes the best RV advice should be clear, honest, and fun.

Amateur adventurer; professional dreamer.

aka: The Bish-Blog-Guy